What Kind Of Projects Qualify For Home Improvement Tax Credits?

It's always gratifying to make improvements to your home. But most people don't know those home updates could also come with pretty sizeable tax credits! The US government offers home improvement tax credits to encourage Americans to make their homes more energy-efficient or to benefit small business owners and families with special medical needs. If you complete a qualifying home improvement, you can receive a tax deduction for the year you did the project. So, if you’ve been thinking about home upgrades, see if any qualify for a home improvement tax credit.

Get Tax Credits For Your Energy Efficient Home

You’ve probably heard how energy-efficient products can save you money on energy costs. They can help save you money on taxes, too. In recent years, the federal government has offered tax credits for energy-efficient home improvements. These tax credits apply to taxes owed when you file for the year you made the improvements.

The rules are subject to change each year, but qualifying energy-efficient projects may include:

- Installing solar panels

- Purchasing an energy-efficient central air conditioner

- Purchasing an energy-efficient furnace

- Replacing exterior windows or doors with Energy Star-compliant options

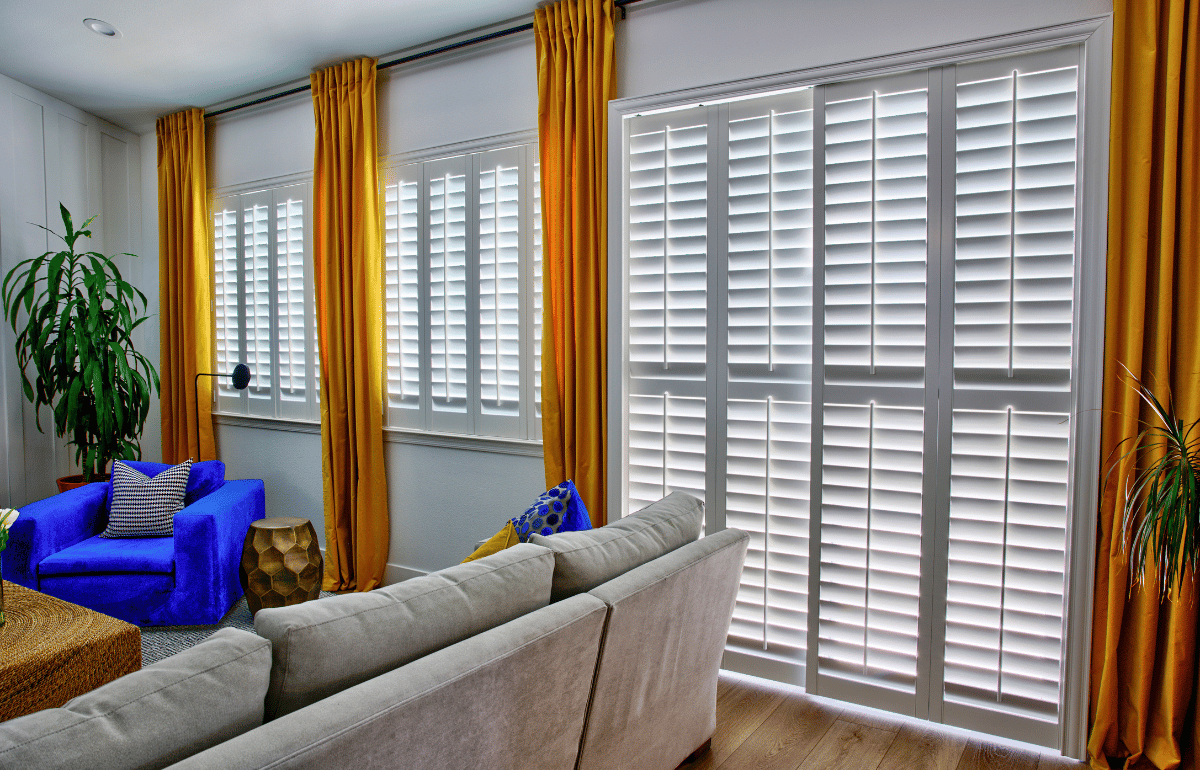

- Installing insulating Polywood® plantation shutters

Upgrade Your Home Office For A Tax Deduction

Small business owners can always use a tax break. Surprisingly, you might earn one by revamping your home office! Home office repairs and improvements may qualify for tax deductions if:

- Your home is your principal place of business

- You use your home office exclusively for business

Always check the current year’s guidelines to ensure your project qualifies. Changing trends in working from home may alter what qualifies for this tax deduction year to year.

Accessibility Alterations Can Get You A Tax Deduction

Not many home improvements qualify for federal tax deductions, but certain medical care alterations might. If you install medical equipment in your home to care for someone living there, the project may save you money on taxes.

Check current federal rules and see if these or other projects qualify for a tax deduction when you put them in your home:

- Accessibility lifts

- Entrance and exit ramps

- Widened doorways and hallways

- Accessible smoke detectors and alarms

- Shower support bars

Increase Your Home’s Value And Your Chance Of Earning A Tax Deduction

Planning to sell your home in a few years? Major home improvements can be tax deductible when you sell your home. These improvements must be “capital improvements” that last more than one year and add real value to your home. Such projects might include:

- Installing a new furnace

- Adding a new bathroom

- Finishing an attic or basement

- Building on an addition

To get your deduction, you’ll need proof of the money you spent on your home improvements, so save itemized receipts and track project costs — including labor and materials.

Let Sunburst Show You How To Get A Tax Credit For Polywood Shutters

Get all the benefits of energy-efficient Polywood shutters and maybe a tax credit when you choose Sunburst Shutters & Window Fashions for your window treatment installer! We’ll give you a free consultation to help you pick your shutters and explain the process of applying for a tax credit. Call 877-786-2877 or fill out the form below to schedule your appointment today.